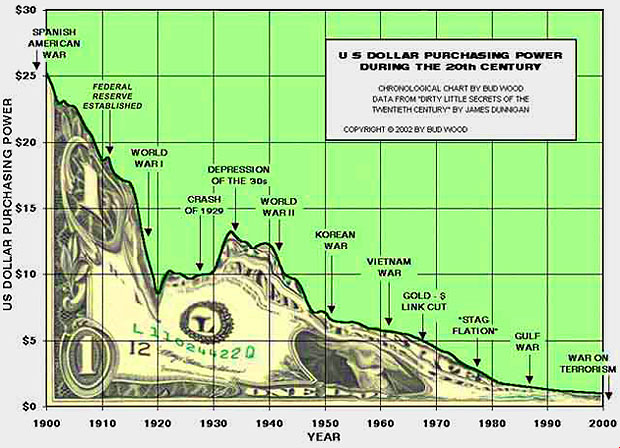

Cash is trash

Dollar in decline

got gold?

Wednesday, December 12, 2007

FED bluffs, then folds. Gold wins

Monday, December 10, 2007

Chinese now primed for Gold

Monday, December 10, 2007 6:19:52 AM

Author: John Reade, Robin Bhar

UBS Metals Daily

China's wealthiest investors set for gold spree

China's wealthiest investors are on the brink of ploughing as much as $68 billion into gold markets as they take profits from roaring share prices and steer clear of property, a top fund manager and bullion bull says. Wang Weilie, a pale, bespectacled 40-something who manages over 1 billion yuan ($135 million) on the Shanghai Gold Exchange on behalf of himself and clients, says the so-called "Zhejiang clique" are ready to pounce after Beijing opens up spot market bullion trading and a futures contract launches early next year. After amassing an estimated 3 trillion yuan ($400 billion) from investing in red-hot real estate and stock markets which have risen five-fold in the past two years, the wealthy group from eastern China is looking for the next sure bet. Wang says that's gold, and expects the amount of Chinese capital invested in the bullion market to soar 100-fold to some 500 billion yuan ($67.5 billion) in the next two years -- a sum that could catapult China ahead of India as the world's top buyer. "We all agreed that upside room on stocks was limited, as was upside on property prices. But the gold price has only increased minimally, even after 20 years of China's reform and market opening," Wang told Reuters during a lunch with three business partners in Lujiazui, Shanghai's financial hub. Coupled with inflation and global economic uncertainty, the redirection of Chinese capital towards domestic gold contracts will help spot prices more than double, says Wang, who says he once cornered two-thirds of the Chinese gold forward contract. "Spot gold prices will hit $2,000 in coming years," he said. Spot gold touched a 28-year high of $845.40 per ounce in early November, nearly doubling over three years amid a flood of investment in the commodities complex -- much of it driven by China's growing demand for raw materials to fuel its economy. Wang expects more than 15 percent of the capital currently invested in China's stock market to move to gold trading. China's total market capitalization peaked at about 35 trillion yuan in October, exceeding the country's gross domestic product. The main stock index tumbled nearly 20 percent last month while Beijing has continued tightening controls over the property sector to limit price gains (Reuters).

Tuesday, November 6, 2007

Quantum leap for gold

Enjoy -Bryan

...Credit Suisse warned Monday that supply and demand factors “could trigger a quantum upward change in the gold price”. David Davis, a research analyst at the bank said: “Our studies indicate that the dynamics surrounding the gold supply and demand have begun to change inexorably towards a diminishing supply of gold and increasing investment demand, which will ultimately impact the gold price.” The prediction is based on the assumption that “long term global gold production will begin to decline as the diminishing number of new reserves fail to compensate for dying mines”.

We would concur with Credit Suisse in this regard and believe that gold will experience a quantum jump in the coming months. A quantum upward change or jump is a sudden spectacular advance in the price and one which dramatically skips over intermediate stages. This could result in a gold price over $2,000 per ounce in a short period of time.

Friday, November 2, 2007

lies, damned lies and statistics

The US dollar falls to new record lows and oil and gold prices surged to new highs, meanwhile Wall Street fixates on meaningless government data that managed to report the lowest inflation in the last half century. These illusory numbers were integral in allowing the Commerce Department to report 3.9% annualized GDP growth in the third quarter, which was heralded by the bulls as evidence that a resilient U.S. economy had shrugged off the problems in the housing and mortgage markets. However, the government's ability to make "economic growth" magically appear is based purely on statistical finesse.

To arrive at this rate, the government had to assume that inflation during the quarter ran at an annualized rate of .8% (that's less than 1%). That is the lowest rate of inflation used to calculate U.S. GDP since the Eisenhower administration. With oil priced at almost $100 per barrel, gold futures trading over $800 per ounce, the dollar hitting record lows, and the Fed printing money like it is going out of style (12.9 % as measured by the old M3 model) the government has the nerve to claim that current inflation is the lowest it has been in half a century. Unbelievable!

Just in case there is some confusion, the government adjusts nominal GDP gains using the GDP deflator, which represents the inflation rate during the time period being measured. This is done to strip inflation out of the GDP calculation so that only real growth gets counted: not nominal gains that result purely from inflation.

The consensus estimate for 3rd quarter GDP growth was 3.4%. The reason we beat that number was that the government adjusted the nominal 4.7% gain by a mere .8%. Had the government assumed a higher rate of inflation, say 2.6% (identical to the rate used to deflate second quarter GDP,) the 3rd quarter gain would have been only 2.1%, well shy of the consensus forecast. My guess is that inflation is actually running at an annualized rate closer to 10%. Therefore using a more honest deflator, the U.S. economy is actually contracting, which would explain the recent anecdotal evidence provided by various economic polls, voter dissatisfaction and consumer sentiment numbers. In fact, if one simply measures U.S. GDP using gold or any other currency, it is clear that the US is already in a recession.

Dont believe their hype. got gold!?

Tuesday, July 17, 2007

How rare is gold?

Thursday, July 5, 2007

10 % gainers

Back from my hiatus.

My four stocks that I touted for at least 10% in 6 weeks all made the mark except ECU which got real close, if memory serves it hit 2.78, so I missed by only .025, the others hit quickly, RSC was probably the best performer going over 3.50 (forgive me Im too lazy to check the charts) and XAU over 2.30, and CGP went over. 71

Now lets look at the prices today. ECU has been rocked by a financing that took it to the low 2's , has since recovered and is today 2.38 high so far, I recommend it as a buy here (2.28) I have a large core position.

XAU 2.18 high today, still holding a small core position.

RSC- I am out. On its last run to a 52 week high of 4.00, I sold most at 3.85, some at 3.91 and 3.74. Today RSC is a high of 2.48, and has taken a good beating the last little while. I timed this one almost perfectly, and I am staying away from uranium stocks for fear of a severe correction in the price of U308.

Monday, March 26, 2007

+10% minimum in 6 weeks

ECU 2.55

XAU 2.03

RSC 2.96

CGP 0.64

Wednesday, March 14, 2007

Subprime mortgage meltdown

Since late 2006, 36 U.S. mortgage lenders have gone bankrupt, and there is talk in Washington of possible bailouts. Even GM is taking a hit from its finance division and exposure to subprime paper. And since the Fed can not afford to raise rates right now with the subprime mortgage meltdown going on, the dollar gets discounted.

Gold and silver are selling off as they track the equities, there is a flight to liquidity, but at some point I think the U.S. dollar is going to come under some serious selling pressure, and the dollar and the gold price will decouple. The fed may even have to lower interest rates to save housing, this too will help trigger a gold rush.

Tuesday, March 6, 2007

More real inflation numbers

United Kingdom M4 was up 13%

Euro zone M3 was up 10.6%

China M2 was up 15.9%

South Korea M3 was up 10.6%

Australia M3 was up 13%

Russia M2 was up 48%

Thats why I call this site "cash is trash"

Tuesday, February 27, 2007

Frenetic trading pace today. Many bargains

Got back my cristopher james CJG at .80, bought some more cornerstone capital CGP at .81, strateco at 3.28 which I have now sold at 3.42, more BVG, more RFM, more FMM, and even got some ECU because they released good news today. The panic sellers have made my day. Looking forward to $730.00 gold

Wednesday, February 14, 2007

sold most of my christopher james gold

We have to take advantage of these pumps, and do some dumping, I hope to buy back under .90, but there is a bid wall of 102000 shares sitting at .90, but we all know depth can disappear in an instant. happy trading.

Monday, February 5, 2007

My only uranium play

Monday, January 29, 2007

stocks im buying

UC resources low .50's UC-TSXV, thay are producers now, and have been as high as .61 last week, I will carry a considerable holding over 1.00

Cornerstone capital resources low .70's CGP-TSXV, back to 1.00 soon

real US inflation

The inflation rate of the US dollar is roughly 10% as measured by the now defunct M3 number. The 3 year US bond pays 4.92% yielding a return of NEGATIVE 5%.

how do you protect yourself? BUY GOLD.

Thursday, January 25, 2007

Almaden and Northlands

Yesterday good news came out from Almaden minerals AMM-TSX , my latest buy was 2.61 and today I bought more at 2.80/2.82. Almadens high grades will push us to new 52 week highs before the summer. Long and strong on AMM.

Northland resources NAU-TSX has been a beautiful thing lately, I have daytraded it daily for large profits, and carried a large core position forward from 1.28 to today where we hit as high as 2.25.

NAU is being promoted heavily in scandanavia this month and looks to move higher still.

Tuesday, January 23, 2007

Break to the upside

We have built a base and have remained above the 300-day moving average in recent days. The harsh beatings laid on oil and some of the base metals this year has handcuffed gold and silver, but they have held up well.

The US dollar fell out of bed today as OPEC nations unloaded Treasuries at the fastest pace in more than three years as crude oil prices tumble, sending bond yields higher. For every $10 drop in the price of a barrel of oil, OPEC members adjust Treasury holdings by about $34 billion, according to estimates by Michael Pond, an interest-rate strategist in New York at Barclays Capital Inc.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/quotes_special.gif)